- Let’s Talk Money

- Posts

- Issue #033: How to get out of debt

Issue #033: How to get out of debt

Read Time: 3 mins

Read Time: 3 mins

🤑 Hey everyone,

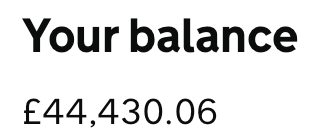

My total debts: £44,430.06

(plus I think I owe my mum a Fiver)

Thanks a lot student loans🖕

A few weeks ago I received this question:

What’s the best way to get out of debt?

What better way to open a newsletter than answers that question then by sharing with you the level of debt I’m currently in…

I know I’m a bit off.

So before I answer the question, I want to explain why I shared the numbers above.

How can a guy that preaches personal finance be in debt?

I educate people about personal finance, so I think it’s important to share a really transparent view into my own personal finances.

I don’t have everything perfectly sorted, but I am constantly learning and improving.

And as long as you are doing that, you are heading inthe right direction.

So having said that, here is how you get out of debt, from someone actively doing it themselves!

How to get out of debt:

Step one: Write them down

Gather every single debt you have together in a single table using the following headings (I’ve added some example’s below

Debt Type | Debt Amount | Interest Rate |

|---|---|---|

Mortgage | £250,000 | 3.2% |

Car Finance | £4,000 | 8.9% |

Credit Cards | £6,300 | 26.7% |

Step 2: Split your debt’s into good and bad debt

Good debt is the with interest rates below your magic number, bad debts are the opposite, those with interest rates above your magic number.

Magic number: The % return you would get if you put your money elsewhere

Example: I can either pay of my debt, or invest that money for the long term, where I hope to get an average return of at least 8% over a 10 year period.

Therefore my magic number is 8%

Debt Type | Debt Amount | Interest Rate | Type |

|---|---|---|---|

Mortgage | £250,000 | 3.2% | GOOD |

Car Finance | £4,000 | 8.9% | BAD |

Credit Cards | £6,300 | 26.7% | BAD |

You are then going to focus on paying off the bad debt as aggresively as possible, by cutting back on as much as you can.

You can continue to make minimum payments on the good debt, as long as the extra money that you could use to may off this debt is actually going towards that higher interest place (i.e. investing)

Step 3: Pick your method

There are typically two methods to paying of debt.

Avalanche method: Pay off the highest interest rate debt first as this is mathematically the most optimal way to pay the least amount when repaying debt.

That would mean paying off credit cards first, and then car finance.

Snowball Method: Pay off the smallest debt amount first as you will be able to pay this one off the quickest, keeping you motivated to keep going. In other words, the most pyschologically optimal way to pay of debt.

That would mean paying off car finances first, and then credit cards.

Finance guru’s on the internet will argue for days about which method is better, but here’s my take.

PICK THE ONE THAT FEELS RIGHT AND JUST STICK TO IT.

I don’t care if you prefer pyschological or mathematical comfort, as long as your debt level are going DOWN and not UP.

Step 4: Make hard choices

Debt is absolutely bloody awful, so you will need to make really hard choices to get your finances back on course. That might mean cutting back your costs to the bone and reducing the nice things in life to absolute minimum whilst you get through this period.

Step 5: Seek help if needed

There are plenty of amazing charities out there where people who don’t know you and can’t judge you can give you real practical help as they are experts on this subject.

Check this link here for the government website on more support.

They can advise on things like balance transfers, tactics to reduce interest rate, and much more that can help take pressure of your shoulders!

DONT WAIT, START NOW!

| Thank you once again for spending some of your time with me & reading Let’s Talk Money. Talk soon, Gabriel - That Money Guy |

Whenever you're ready, there are ways I can help you.

1. Hit reply to this email: I respond to every single question I get from these newsletters, so please don’t be shy!

2. The Budgeting Template PRO: Most of you have probably tried the lite version, but the PRO is what I use in my day to day life. (use the code ‘letstalkmoney’ for 30% off)

DISCLAIMER: None of the above is financial advice. This newsletter is strictly education and should not be taken as investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and always do your own research.