- Let’s Talk Money

- Posts

- Issue #041: Why should you give a **** about investing? 📈

Issue #041: Why should you give a **** about investing? 📈

Read Time: 3.5 mins

Read Time: 3 mins

Investing… I might as well gamble?

Investing… It’s too complicated?

Investing… Don’t I need to earn more?

Those are the 3 most common questions that I get about the topic.

And whilst I would love to answer them (again 🤦) in this week’s newsletter, I actually received a new question last week which really got me thinking:

Investing… who really cares?

Damn… talk about hitting me right in the feels.

But it’s a good question, one that you all should probably have already asked yourself.

And if you give me the next 3 minutes of your life, I’m gonna try my best to get YOU to care about investing, hopefully enough so that you FINALLY get started:

👀 Your money is literally dissapearing

That’s right, the money in your bank account is currently becoming less and less value as it sits there.

Don’t believe me?

It’s called inflation.

The concept that the purchasing power of your money decreases year on year.

For example that crisps £10 note that you’ve been holding onto for 10 years. Well that’s now only worht £7.34

(If you want to play around with an inflation calculator, you can do so HERE)

Investing is one of the best tools that the ‘average’ person has to try and combat inflation, to try and make sure your money is GROWING rather than staying the same or even worse, SHRINKING!

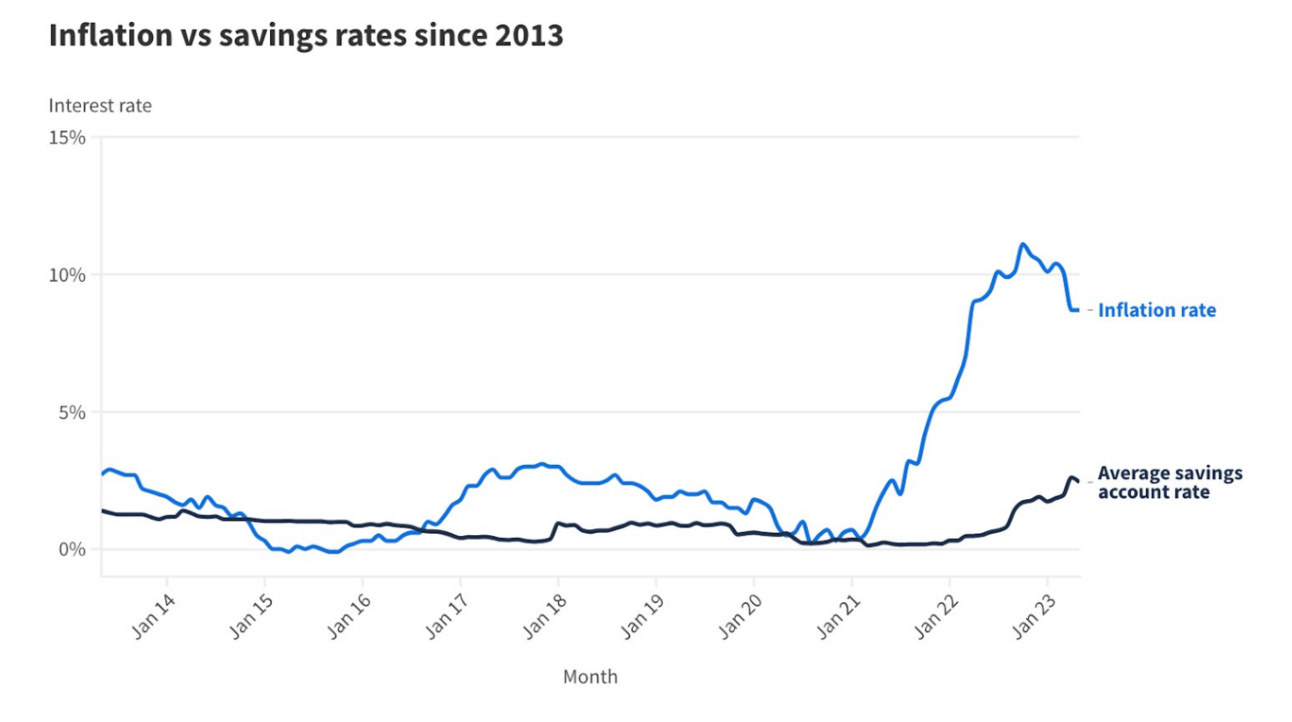

And if you think that a saving account is the solution, check below to see how often the average savings account rate beat inflation between 2013-2023

The answer: NOT OFTEN

👴🏻 You should care about your future self

I’m not just talking about you in 1 or 2 years, I’m talking about you in 10/15 or even 35 years.

Before you tell me that is what your pension for, I’m referring to the years before your able to access it!

You see, you might have big plans for your future.

Maybe it’s taking a break from work, traveling the world, or helping your kids buy their first home.

But if you’re only relying on your pension, you could find yourself in a tight spot, because that money is locked away until you hit retirement age.

That’s where investing comes in.

It’s about investing for the “future”, those big goals that don’t quite fit the short term savings bucket.

Investing is one of the best tools for that period of your life!

🤔 CHOICE!

Choice

That’s what investing is really about.

It’s not about getting rich or beating the market, it’s about giving yourself options.

The choice to take a break from work if you need to. The choice to say yes to that spontaneous trip. The choice to help out a friend or family member without hesitation.

At the end of the day, investing is all about trying to grow your wealth, but why is that important.

Wealth doesn’t buy happiness. It doesn’t guarantee health.

What it does do is give you the freedom to make decisions based on what you want, not what your bank balance dictates.

Imagine being able to say yes more often. Yes to new experiences. Yes to spending more time with your loved ones. Yes to pursuing a passion project without worrying about the next paycheck.

It’s not about having all the money in the world; it’s about having enough to live life on your own terms.

So, if you’ve been holding back because it seems too risky, too complicated, or too much for “someone like you”—remember, you’re not investing just for the returns. You’re investing for the ability to choose your path, no matter what life throws at you.

Because at the end of the day, isn’t that what we all want? The power to choose the life we live, instead of just accepting the one we’re given?

So, what will you choose?

BONUS SECTION

If you’ve got to this point and you’re ready to get started with your investing journey, I am SO EXCITED for you!

And why not check out my favourite investing platform as I think it is the BEST place to get started!

👇👇👇👇👇

📈My Favourite Investing Platform

The no.1 question I always get asked whenever I talk about investing is what is the best platform to start on. Over the past few years, I have tried pretty much every major player in the game, and I can safely tell you that I have hands down found the best one that ticks every single bucket when it comes to investing.

Not just that, when I shared with them just how much I loved using them, they asked if they could sponsor my weekly newsletter and give all of you an amazing offer.

OBVIOUSLY I SAID YES!

Any guess who the platform is yet?

Of course, it is the amazing Trading 212! the platform I currently use (AND LOVE) when it comes to investing.

If you sign up for a Trading 212 Investing account or a Stocks and Shares ISA through:

or use code GN, you can get a free fractional share worth up to £100 when you sign up and deposit £1.

Remember that when investing, your capital is at risk and your investments may rise and fall. T&C’s apply.

I WANT TO TRY SOMETHING A LITTLE DIFFERENT

YOUR BUDGET

I would love you to spare a moment to share your budget to whatever details you are able to to!

How much do you make?

How much do you take home after tax?

How much do you spend on the following categories: (Needs/wants/savings)

How much do you have in all your various saving accounts

How much debt you are in?

Any further breakdown of your spending, for example:

( Rent/bills/Eating out/as many categories as you can)

Remember, just HIT REPLY, and I can’t wait for us to help each other get better with money!

P.s. I will always keep these answer completely anonymous!

| Thank you once again for spending some of your time with me & reading Let’s Talk Money. Talk soon, Gabriel - That Money Guy |

Whenever you're ready, there are ways I can help you.

1. Hit reply to this email: I try to respond to every single question I get from these newsletters, so please don’t be shy!

2. The Budgeting Template PRO: Most of you have probably tried the lite version, but the PRO is what I use in my day to day life. (use the code ‘letstalkmoney’ for 30% off)

3. Remeber to get your FREE fraction share worth up to £100 worth up to £100 when you sign up to Trading 212 with THIS LINK

DISCLAIMER: None of the above is financial advice. This newsletter is strictly education and should not be taken as investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and always do your own research.