- Let’s Talk Money

- Posts

- Issue #64: I Just Bought a House (for the first time)...

Issue #64: I Just Bought a House (for the first time)...

Read Time: 2.9 mins

Read Time: 2.9 mins

🥳 I guess the news is out…

Shifting gears a little bit in today’s newsletter, to share something a little bit more personal.

As you guessed by the title of this email…

I JUST BOUGHT A HOUSE WITH WALLS AND A ROOF AND STUFF 🤯

Fair to say, it needs a little work, but that’s for another time…

🤔 Why am I sharing this with you?!

Because over the next 6 months or so I am going to learn a lot…

This is a completely new area for me, someone who has spent the last few years being a proud renter!

But that has all changed.

I have a mortgage now… eep.

And I want to share with you all the lessons I learn as I head down this path, so you can be better prepared than I am.

Turns out, you have to spend a lot of money before you even get given the keys.

I when I say a lot, I mean A LOT

Naively, I’ve always assumed it was just the deposit you needed.

I was WRONG

So on that note, here are all the expenses I had to fork out before getting handed the keys to my first ever home!

🪙 Every penny I spent Pre-Purchase

💰 Deposit – 10% of purchase price

Kicking off with the most obvious one, the deposit.

This is just a % of the house price, typically 10% or more, and in our case exactly 10%.

(you can get mortgages for less than a 10% deposit, it’s just rare).

Why would anyone put down more than 10% if that’s the least you have to?

Well normally, for roughly every extra 5% of deposit you put down, you can lower the interest rate on your mortgage slightly, easing the burden on your monthly repayments (would be nice ey 😅)

💼 Solicitor Fees – £2000

That’s right, to buy a house you need a lawyer, and they ain’t cheap.

Average prices online say around £1500 for this service, but I guess I paid the London surcharge…

🔍 Survey – £750

This is paying a professional to inspect the property for all the things you wouldn’t know to look out for.

When you buy a property, it’s an imperfect market, as the person selling knows the house inside out where as you can only judge it by what you see on a viewing or two (they know all the hidden quirks you wouldn’t know about unless you lived in it for a while).

That’s what a surveyor is there to do for you, with average costs in the UK coming in at £400-£1500

The reason why the range is so large is that there are different levels of survey depending on the depth you need for your property.

We’re renovating, so needed slightly more depth to ours!

🏦 Mortgage Fees – £500

This one is two fold:

Fees you pay to the mortgage advisor to get you a mortgage

Fees you pay to the mortgage provider when they give it to you

We only paid the second one to Nationwide to secure our mortgage as our mortgage broker was free (lots are)

📑 Stamp Duty – A LOT

I’ll drop a table below that will let you work it out, but lets just say if you’re spending over 500k, it starts to get ugly…

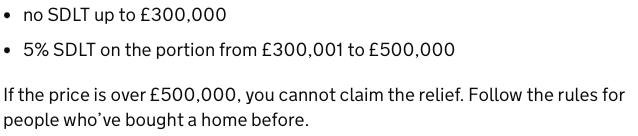

FIRST TIME BUYER

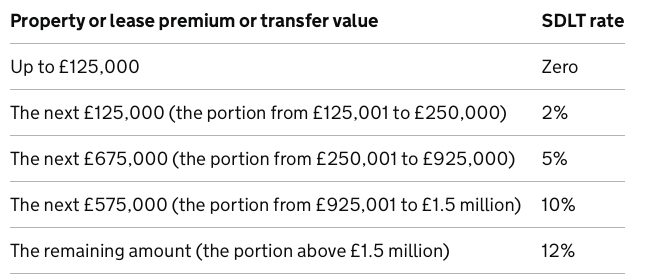

NORMAL BUYER

So for example, if you were buying a £500k house:

First time buyer stamp duty = £10,000

Normal buyer stamp duty = £15,000

🚚 Moving Costs – [£50-500]

I was quoted an average price of £100/hour to hire someone to do this for me…

So instead, I hired a van for the day for £65, borrowed my dad, and we did it ourselves

Let’s just say it wasn’t pretty.

Don’t forget storage costs if you’re between places as well!

👨💼 Insurances – £300 ish

Fully personalised to your level of cover but this might include:

House Insurance

Content Insurance

Mortgage protection insurance

These are important!

⚠️ Surprise Costs – £…

So our surveyor made us aware of a slight problem with our property…

ASBESTOS

Now this stuff is fully manageable, it’s just annoying and requires another survey along with paying someone to remove or manage it.

Some people choose to use this information to lower the price they are willing to pay for the house before you exchange, some (like us) don’t.

Now this isn’t the only surprise cost, it was just the one we had to deal with, but there are plenty of other things that might crop up

Here’s a list Chat GPT suggested could occur:

Drainage & CCTV Survey

Structural Engineer Costs

Specialist Surveys

Indemnity Insurance

Re-survey Fees

And that’s it for today friends. See you next week 😁

Got a question you’d like answered in next week’s newsletter? Just hit reply! Let me know your question and whether you’d like to stay anonymous.

| Thank you once again for spending some of your time with me & reading Let’s Talk Money. Talk soon, Gabriel - That Money Guy |

DISCLAIMER: None of the above is financial advice. This newsletter is strictly education and should not be taken as investment advice or a solicitation to buy or sell any assets or to make any financial decisions. Please be careful and always do your own research.